After loading a new window in 1s 8.3. About interesting things from the world of IT, instructions and reviews. Reclassification of fixed assets

The All-Russian Classifier of Fixed Assets (OKOF) was created to classify fixed assets in organizations, enterprises and institutions of all forms of ownership. By default, in 1C: Accounting 8.3 the OKOF directory is not filled in. To download it, you must follow the instructions described below.

1. Download the archive with the OKOF classifier as follows to your desktop.

2. Inside this archive is the file okof.xml. Unzip (pull out) this file to your desktop.

3. Open the “All functions” menu. If you do not have this item - you.

4. In the window that opens, expand the list of directories (plus sign on the left).

5. Among the directories, select “OKOF Classifier” and click the “Open” button.

6. The OKOF classifier has opened. As you can see it is empty. Click the “Load OKOF classifier” button.

7. The download window opens. Click the “Open file..” button and select the okof.xml file downloaded in the first step on your desktop.

8. Click the “Download data” button.

OKOF is an all-Russian classifier of fixed assets. In order not to make a mistake when choosing a depreciation group when adding fixed assets in the 1C Enterprise Accounting 8 program, you need to download the OKOF directory into your database. I will tell you how to do this in this article.

How to download OKOF in 1C: Enterprise Accounting 3.0?

How to find the okof.xml classifier file for your configuration is described above. Let's launch 1C: Enterprise Accounting 3.0 in Enterprise mode. Let's go to the section “Fixed assets and intangible assets”. In the Directories and settings subsection, click OKOF Classifier:

In the next window, click Open file to select the okof.xml file:

Select the okof.xml file and click Open:

After selecting, click Load data:

After loading is complete, go back to the OKOF Classifier tab, press F5 to update the information in the tab and see the loaded classifier:

How to download OKOF in 1C: Enterprise Accounting 2.0?

The OKOF directory file for 1C BP 2.0 is written when installing a configuration or updating a configuration in the 1C templates directory. If you update the program from Enterprise mode, and not through the configurator, then this file may not be on your computer. You can check this as follows. Launch 1C, click Settings and look at the path to the directory of configuration templates and updates:

Follow this path. There should be an Accounting folder in the 1C folder, if it is not there, then read in this article how to download and install the update from the site users.v8.1c.ru. For convenience, temporarily copy the okof.xml file to your desktop or any other folder:

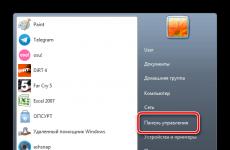

Now we launch your database in Enterprise mode. Go to Operations => Directories. If this option is not displayed in the Operations menu, you will need to switch the interface to Full. To do this, go to Tools => Switch interface => Full.

Find the reference book “All-Russian Classifier of Fixed Assets”:

Now you need the okof.xml file. Click Select and specify the path to the file:

Starting from 2017, the service life of fixed assets intended for depreciation will change. Since this year the new OKOF classifier (All-Russian Classifier of Fixed Assets) 2017 will be relevant, and therefore the accountant needs to make certain adjustments. These changes were adopted in accordance with the order of Rosstandart dated December 2014. In this regard, the previous classifier ceases to operate. As before, in new version There are ten depreciation groups, but some of the assets have been transferred to other groups. At the same time, working with the new OKOF codes in 1C is not at all difficult.

Let us remind you what OKOF and ENAOF are from the point of view of 1C terminology.

Directory "OKOF"

The directory contains an all-Russian classifier of fixed assets. The directory is used to classify fixed assets when accepted for accounting to determine the depreciation group. The OKOF code is indicated for the fixed asset in the OKOF field.

Directory "ENAOF"

The directory contains a classifier of fixed assets for which standard codes and annual depreciation rates are established. This directory classifies fixed assets for which depreciation is calculated according to ENAOF. For motor vehicles, depreciation rates are used as a percentage of the cost of the car per 1000 km. Code according to ENAOF is indicated for fixed assets in the Code according to ENAOF field.

Download OKOF and ENAOF

So, in the update folder, after installing the next 1C release, two files should appear: enaof and okof.

You can also download the okof.xml and enaof.xml files directly from our website. The files are suitable for any 1C configuration: Accounting, Integrated Automation, SCP, ERP.

- Download OKOF 2017 for 1C - file

- Download ENAOF - file

- Download OKOF in word - file

If you downloaded a file from our website, you will need to unzip it before installation.

Install and download the new OKOF and ENAOF

To update or install directly, go to the section called “Directories”, then select “OKOF Classifier” in the “OS and Intangible Materials” section.

On the form, click the "Download OKOF classifier" button

After the window appears in front of you, click here “Select file”, find the directory in which the classifier files are located, and select the file okof.xml or enaof.xml directly.

The new classifier is implemented in the form of a directory with a hierarchy of elements, so you can select any item as a value.

For fixed assets that began operating in 2017 and later, the OK 013-2014 classifier is available; it determines the corresponding position of these assets in the tax return. As for old fixed assets that were introduced before 2017, the following parameters are retained - norm and period. Only the codes change. There is no specific correspondence between the new and old code versions. For the transition, special keys are required, which are listed in the order of Rosstandart. You can see the transition table from old to new OKOF.

The ENAOF classifier did not change in 2017, but it still makes sense to check its relevance.

To load the ENAOF classifier, you must first click the "Open and read file" button, and if necessary, set the "Rewrite objects" flag. After the file has been read, click on the "Download" button.

In 1C Accounting 8, some directories are not filled out manually by pressing a button Add. As a rule, these are directories with standard data approved at the state level. I have already written about the features of working with such reference books on the site earlier.

Data from such directories is either added individually through selection from a classifier built into the configuration, or loaded from an external file. An example of the first case would be a reference book "Units of measurement", and the second - KLADR. Now I will consider another case when it is necessary to load a directory into the database from an external file, namely, loading a classifier of fixed assets (OKOF).

Loading OKOF into 1C Accounting 8.2 is done from the file okof.xml, which by default is located in the directory with 1C Enterprise infobase templates. This file You can also easily download it from the Internet - it’s easy to search and takes up very little space. However, when downloading from the network, you should make sure that it matches your configuration version, otherwise an error message will appear when loading.

There was an important part of the article, but without JavaScript it is not visible!

Features of loading OKOF in 1C Accounting 8.2

The OKOF directory is required when specifying the OKOF code for a fixed asset. The depreciation group is also taken from this reference book. The figure below shows OKOF, open in selection mode.

If OKOF is open in selection mode, then it does not have a classifier loading button! To load the OKOF directory into the 1C Accounting 8.2 database, you need to open it “just like that”. To do this you need to go to the menu "Operations / Directories" and find the fixed assets classifier there. In this case, as you can see in the picture below, a button appears in the reference window "Load classifier".

After reading the classifier, its tree structure will appear in the window, in which the sections required for loading are checked. You can check all the boxes or select only the ones you need – there’s not much difference. Next press the button Download at the bottom of the window and wait for the download to finish, after which the download window can be closed.

Comment: in version 8.3, the fund classifier is loaded immediately and the selection window does not appear. This is not a problem, since, unlike the address classifier, OKOF data does not take up much space in the database.

Video tutorial on loading the fixed assets classifier (OKOF) into the 1C database

To download OKOF to new base, you will need the reference file in XML format(okof.xml). You can download it on our website. We give an example for version 1C Accounting 8.2.

Let's sum it up

As you can see, the main problem is that the button for loading the OKOF classifier is missing in its window if it is opened in selection mode, that is, using the button with an ellipsis. You just need to open the classifier from the list of reference books and the button will appear. That's how the program works.

You can familiarize yourself with this and other similar tricks in my distance courses 1C Accounting 8, conducted via Skype. More about the benefits modern method distance learning you can read it via Skype via the Internet.

What is OKOF? The concept of the All-Russian Classifier of Fixed Assets is familiar to all specialists responsible for accounting for enterprise assets. OKOF was developed for systematic work with funds or, which in this case is the same, fixed assets (FA). When compiling it, the standards and principles of accounting, statistical and international accounting were taken into account.

How does this work? All enterprises in the course of their activities, one way or another, acquire and use OS. Each acquired unit of property is assigned an individual depreciation group. The period for write-off, that is, the use of fixed assets, depends on the depreciation group code assigned to them. This means that the cost of fixed assets according to OKOF will be written off as expenses within a certain period established by the enterprise.

To classify property assets into certain depreciation groups of fixed assets until 01/01/2017, classifier No. 359, approved by Gosstandart in 1994, was used in accounting. The document was very voluminous, so it was inconvenient to use. It was used for more than 20 years and constantly underwent adjustments. Despite this, the OKOF directory has lost its relevance, and many definitions and characteristics of the OS classification are outdated. Therefore, on January 1, 2017, a new one was introduced into circulation.

Major changes to OKOF

Newest help system OKOF, which came into force in 2017, has undergone major improvements and changes compared to the previous one. It was developed with a focus on international accounting systems: during the development, the codes of economic activity of enterprises (OKPD) were taken into account, the composition of depreciation groups, and the write-off period for fixed assets changed. The key changes in the new OKOF affected the structure of the codes - instead of nine characters, the codes now consist of twelve, and the composition of seven generalizing groups.

The first 3 digits of OKOF indicate belonging to the main group of fixed assets, and the rest - to OKPD2 according to CPA 2008 (to types of activities).

Basic OKOF codes

- 100/Residential buildings, premises;

- 200/Buildings, except residential, structures;

- 300/Machinery and equipment as well. household equipment and other objects;

- 400/Weapons Systems;

- 500/Cultivated biological resources;

- 600/Costs for transfer of ownership of non-produced assets 700/Intellectual property objects.

Subgroups have been created in each group and each OS is assigned a specific OKOF code.

Transition to the new OKOF in 2017

When commissioning operating systems purchased in 2017, enterprises should definitely use the new OKOF. On the contrary, the principle of accounting for fixed assets acquired before January 1, 2017 should not be changed. Considering depreciation for fixed assets put into operation before 2017, you should adhere to the previous procedure, that is, do not change the previously established write-off period.

For a comfortable transition to the new OKOF within the specified time frame, you should adhere to Rosstandart Order No. 458 of April 21, 2016. The document presents a comparative table of “old” and “new” OS objects and the so-called “transition keys”. All information is presented in the form of a table, with which you can easily select a new encoding for the OS.

The table indicates all positions that are not currently included in fixed assets, i.e. which do not need to be depreciated and transferred to fixed assets.

In the new OKOF, many objects that were previously used as fixed assets and for which depreciation was calculated are no longer classified as such. Actions with such funds are as follows:

- We clarify the correctness of the old OKOF code, valid until 2017;

- Install new code OKOF, using the table of transition keys (Order No. 458);

- We enter information into the OS inventory cards and note that application begins on January 1, 2017. Property put into operation before 2017 does not need to be re-qualified; only the code values need to be changed.

- If, according to the new procedure, the property is classified as inventory, then it should also be transferred. But this, in turn, also applies only to objects that have arrived at the enterprise since the beginning of 2017. OS that were put into operation earlier but meet these criteria should not be transferred to the MPZ.

- We select a new depreciation group for fixed assets registered later than December 31, 2016. The service life of objects delivered before January 1, 2017 does not change. If there is no suitable code, a higher level value should be selected.

Loading the OKOF classifier for 1C 8.3 and 8.2

Since 01/01/2017, enterprises have been using both the “old” and “new” OKOF. The “old” OKOF is already loaded into the 1C program and is used in work, but for all newly introduced operating systems in 2017, OKOF with new terms of use is used. For proper operation from the OS we need to download and switch to the new OKOF in 1C.

How to load OKOF in 1C

Let's consider loading the OKOF classifier into the 1C program using an example.

To update OKOF in 1C Accounting 8.3, go to “Directories” in the “Fixed Assets” section and find the required document.

If the “OKOF Classifier” directory is not displayed on the screen, you should add it to the menu using the settings (the settings button is presented in the form of gears).

A menu opens with a selection of actions from which we select the navigation setting.

On the navigation panel settings screen, select “OKOF Classifier”, click “Add”, and then click “OK”.

As a result, in the “Directories”, in “OS and Intangible Materials” the desired “OKOF Classifier” will be displayed on the screen.

The program prompts you to open the file for download.

To download the OKOF update file in 1C 8.2, select a document that was previously downloaded and saved on the computer.

We click on it, and the 1C program begins downloading the file.

A message appears on the screen:

After the message disappears from the screen, you can proceed to loading the file into the program. To do this, click “Download” in the lower right corner.

At the end of the download, “Download Complete” will appear on the screen, and the current “OKOF Classifier” will be automatically displayed.

New OKOF in 1C since 2017 for OS

Let's look at an example of how to select a new OKOF code for the OS.

When filling out the OS card in the program, the OKOF code is filled in the empty field.

When filling out the OKOF code in the card, you can select information from two different directories: “OKOF Classifier”, valid until 01/01/2017, and “OKOF Classifier”, which came into force after this period.

We select OKOF 2017 in the classifier the desired group depreciation.

We record the data and swipe the OS card.

Updating OKOF in 1C

To update the classifier, let’s go to “Directories” again and select “OKOF Classifier”.

In the Classifier and click “Load classifier”.

An update window with comments opens.

Open the update file that you previously downloaded and saved on your computer.

We hover the cursor over the file, and the download of the OKOF update to 1C 8.3 begins.

The monitor displays OKOF groups that we plan to update. We mark them, click “Download” and wait for the download to complete. The program will display information about the completion of the download on the screen.

OKOF update in 1C is completed.